One of the most common bond requests that our Commercial Underwriting Team is seeing right now is the new Minnesota Family and Medical Benefit Insurance Program, Equivalent Plan Self-Insurance Surety Bond. Before we jump into the new bond requirement, let’s provide some background information on this program.

Starting January 1, 2026, paid leave benefits will go into effect for some Minnesota employees, which will provide payment benefits and job protection during qualifying life events. In total, employees can take up to 12 weeks of medical leave, 12 weeks of family leave, or a maximum 20 weeks of combined leave if they qualify for both types. Consequently, employees can receive paid leave benefits, for situations such as caring for themself or family members during serious health conditions, bonding with a child (through birth, adoption or foster placement), military leave, or safety leave.

Additionally, employers will have new rules and regulations that they must adhere to under this program. While there are a few options for employers on how they want to offer this benefit to their employees, we will focus on the self-insured plan as this is where the bond requirement comes into play.

The self-insured plan allows employers to manage paid leave benefits themselves. Employers must supply employees with a plan that provides the same, or more, coverage as the state plan would offer, employees cannot contribute more to the self-insured plan than they would have to contribute under the state plan, and the self-insured plan must guarantee the same level of job protection that the state plan would provide. To guarantee that the required payment benefits are being provided to employees, employers must submit a Minnesota Family and Medical Benefit Insurance Program, Equivalent Plan Self-Insurance Surety Bond.

Here are some details regarding this new bond requirement-

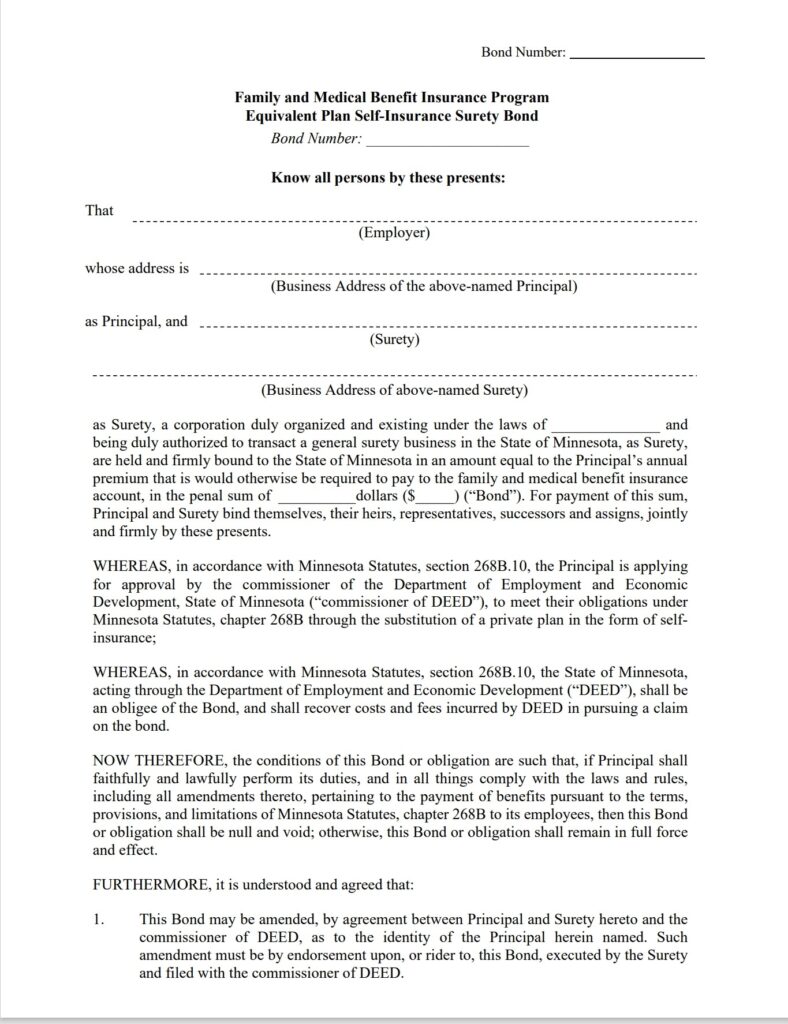

Sample Bond Form:

Only showing page 1 of 4 for the required bond form. Please click here to view the entire bond form – Family and Medical Benefit Insurance Program Surety Equivalent Plan Self-Insurance Surety Bond

Bond Name: Minnesota Family and Medical Benefit Insurance Program, Equivalent Plan Self-Insurance Surety Bond

Obligee: Minnesota Department of Employment and Economic Development (DEED)

Term: 1 year

Bond Amount: The bond amount will be equal to the total amount of premium that would have been paid under the state’s plan. If you’re an employer that needs assistance in determining your company’s bond amount, you can use the State’s paid leave calculator, which can be found here – Paid Leave calculator

Rate: Will be determined based on the underwriting information gathered during the application process

Bond purpose: This bond will guarantee that the employer will make payments to the employees that take qualifying paid leave

Application Process: Goldleaf has surety markets that will consider this type of bond, but they can be more difficult to get written as they fall under the category of a financial guarantee. Underwriters will be looking for well capitalized applicants that can show capital in excess of the bond amount when looking to qualify the company. To start the application process, we will need a commercial application, current financial statement from the company, and a personal financial statement from all owners and spouses (if applicable).

This is by no means a thorough overview of this program. To learn more about who qualifies, what type of situations are covered, how much money you will receive, employer requirements, and much more information, please visit the Minnesota Paid Leave website here – Minnesota Paid Leave / Minnesota Paid Leave.

As always, our team at Goldleaf is here to assist with your bond needs. If you would like to start the application process or you have any questions, please reach out to our New Business Intake Manager, Kendyl Meseck. We look forward to talking with you soon!