One of the items often discussed by Goldleaf Surety underwriters is the “quality” of a company’s year-end financial statements and how these can affect the rates and terms upon which the company can obtain surety support.

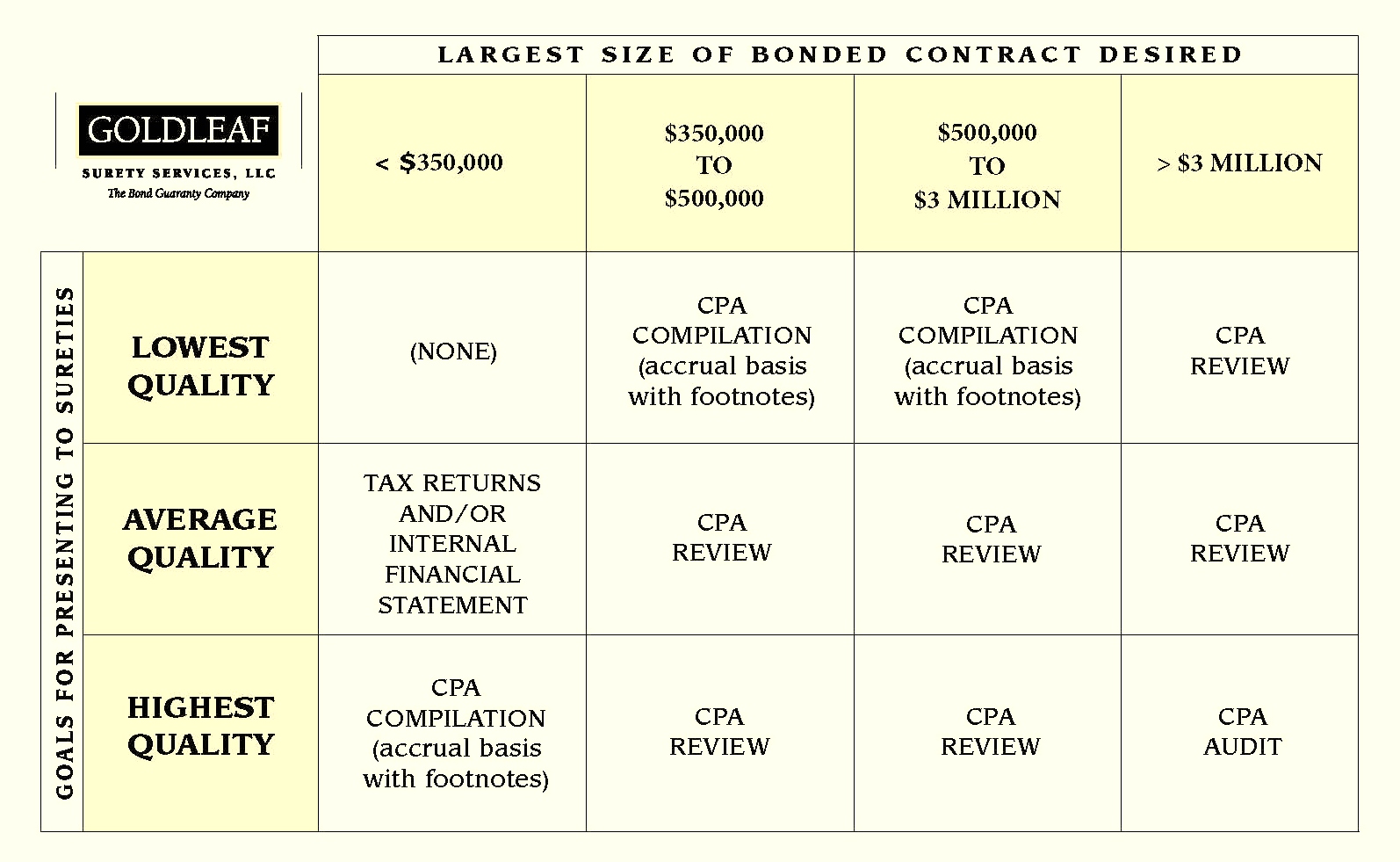

The chart to the below helps identify the various levels of financial statements that can be submitted with a bond application and at what points a company should consider engaging a certified public account (CPA) to prepare its annual financial statements.

When working with agents and their insureds, Goldleaf regularly emphasizes this issue of “quality” because better quality financial presentations generally yield substantially better rates and higher limits. Depending on the size and frequency of a company’s need for surety bonds, the cost of hiring a good CPA-prepared statement can be completely offset by the savings on just one or two bonds.

When working with agents and their insureds, Goldleaf regularly emphasizes this issue of “quality” because better quality financial presentations generally yield substantially better rates and higher limits. Depending on the size and frequency of a company’s need for surety bonds, the cost of hiring a good CPA-prepared statement can be completely offset by the savings on just one or two bonds.

Statements prepared from a company’s annual tax information generally present the weakest picture of that company’s financial position. Companies need to engage CPAs to prepare “accrual basis” financial statements, rather than simple “tax basis” or “cash basis” statements, in cases where the company wants the strongest level of surety support.

Goldleaf Surety has developed the above chart as a guide only. It represents standards used in the surety industry generally, but it is not intended to represent strict standards or “rules” that must be followed in every case or by every company.

Goldleaf Surety specializes in helping clients work around these standards in a variety of industries where they do not apply and for special circumstances where companies need surety support but do not have the qualifying level of financial statements. Goldleaf’s financial and legal expertise often enables us to respond in situations that numerous surety companies decline. We have an exceptionally strong underwriting group, with broad business experience and excellent analytical skills. In many cases, our staff is able to find the merits of an account or a particular project, where other underwriters have failed. Simply stated, we concentrate on the possibilities rather than just the problems, and we are exceptionally good at helping companies obtain the surety bonds they need to grow.