It’s that time of year again to address how your company’s year-end planning issues can affect your company’s bonding program – both capacity as well as terms and conditions.

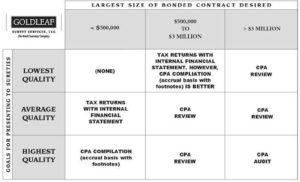

The “quality” of year-end statements is a topic often discussed by Goldleaf Surety’s Account Specialists with our clients. In our December 3, 2014, blog post Surety Bonds and Year End Consideration we discussed the “quality” of a company’s year-end financial statements and how these can affect a company’s surety program. Since that post, the information contained within the chart used to identify the various levels of financial statements that can be submitted with a bond application and at what point a company should consider engaging a certified public accountant (CPA) has had some substantial changes. Below is the updated version of the chart:

Goldleaf has developed the above chart as a guide only. It represents standards used in the surety industry generally, but it is not intended to represent strict standards or “rules” that must be followed in every case or by every company.

In fact, Goldleaf Surety specializes in helping clients work around these standards in a variety of industries where they do not apply and for special circumstances where companies need surety support but do not have the qualifying level of financial statements. Goldleaf’s expertise often enables us to respond in situations that numerous surety companies have declined. Simply stated, we concentrate on the possibilities rather than just the problems, and we are exceptionally good at helping companies obtain the surety bonds they need.

Goldleaf’s Account Specialists can provide counsel to agents and their contractors with both year-end considerations as well as other surety considerations that are needed to grow the company and improve its surety support.